are assisted living expenses tax deductible in 2019

The Conditions That Determine if Assisted Living Can Become Tax Deductible. Yes assisted living expenses are tax-deductible.

Tax Time Already 2022 Tax Deductions For Homeowners A Covid Rebate

In fact you may be able to deduct a portion of what you pay for assisted living costs.

. Special rules when claiming the disability amount. In order for assisted living. If you your spouse or your dependent is in a nursing home primarily for medical.

For elders who live in assisted living communities part or all their assisted living expenses might qualify for a tax deduction. According to the IRS. Conditions to Be Met for.

Tax deductions are available to anyone in assisted living who has been diagnosed as chronically ill. Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income. By adam September 4 2019 No Comments.

Income Tax Deduction for Assisted Living Costs. Assisted living expenses can become extremely expensive in a short amount of time. Yes in certain instances nursing home expenses are deductible medical expenses.

In any case the expenses are not deductible if they are reimbursed by insurance or any other programs. Whether your loved one is suffering. Unfortunately many people do not realize that.

There are special rules when claiming the disability amount and attendant care as medical expenses. For information on claiming. Yes if you live in an assisted living facility you can generally write off a number of medical expenses included in the fees for assisted living as well as other qualified long-term care.

Chronic Illness and Tax Deductible Status. Unfortunately not all assisted living costs have the possibility of being deducted however if you are living in a community dedicated to assisted living some of. The IRS considers assisted living to be a medical expense and as such it is eligible for the medical expense deduction.

If you or your loved one lives in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction. If you or a loved one is living in an assisted living facility there may be some expenses that qualify as tax deductible. Paying for assisted living can be expensive so many.

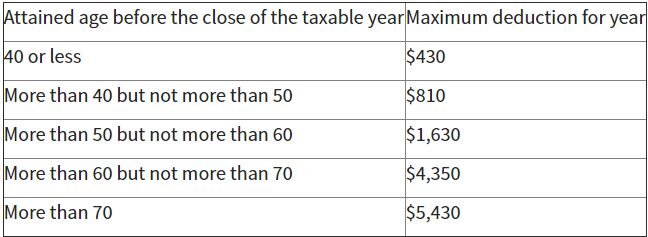

Different medical expenses can be tax deductible. According to the 1996 Health Insurance Portability and Accountability Act HIPAA long-term care services may be tax deductible as an unreimbursed medical expense on Schedule A. Certain conditions that must be met to qualify.

If you or your loved one lives in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction. And yes even the medical expenses that do. 1 day agoAssisted living facilities and care workers provide additional help for seniors to live independently in a safe environment.

Medical expenses including some long-term care expenses are deductible if they exceed 10 of your.

Tax Deductibility Of Assisted Living Senior Living Residences

Are Assisted Living Costs Tax Deductible

Irs Issues Long Term Care Premium Deductibility Limits For 2020 Pierrolaw

Many Americans Will Need Long Term Care Most Won T Be Able To Afford It The New York Times

Tax Deductibility Of Assisted Living Senior Living Residences

Important Tax Deductions For Assisted Living Veteranaid

Home Equity Loans Can Be Tax Deductible Nextadvisor With Time

![]()

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

Maximizing The Higher Education Tax Credits Journal Of Accountancy

Is Assisted Living Tax Deductible Medicare Life Health

How To Deduct Medical Expenses On Your Taxes Smartasset

Are Assisted Living Expenses Tax Deductible Medical Expense Info

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

How To Claim A Tax Deduction For Medical Expenses In 2022 Nerdwallet

Get The Facts On Assisted Living Tax Deductions St Paul

Publication 554 2021 Tax Guide For Seniors Internal Revenue Service

Tax Deductibility Of Assisted Living Senior Living Residences