prince william county real estate tax payments

Payment of the Personal Property Tax is normally due each year by October 5 see Tax Bill for due date. The tax rate is expressed in dollars per one hundred dollars of assessed value.

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

Press 1 to pay Personal Property Tax.

. The system will verbally provide you with a receipt number for you to write down. All you need is your tax account number and your checkbook or credit card. Prince William County Virginia Home.

Be 6 characters or longer. Dial 1-888-2PAY TAX 1-888-272-9829 using a touch tone telephone. Have pen paper and tax bill ready before calling.

Personal Property - per 100 of valuation Due to the low tax rate 00001 per 100 of assessed value for property tax classifications listed below no tax bills are generated if the assessed value is 50000000 or less. There are several convenient ways property owners may make payments. When are property taxes due in Virginia County Prince William.

Click here to register for an account or here to login if you already have an account. Provided by Prince William County. A convenience fee is added to payments by credit or debit card.

For example if the total tax rate were 12075 per 100 of assessed value then a property with an assessed value of 300000 dollars is calculated as. Enter the Account Number listed on the billing statement. Prince William County Property Tax Payments Annual Prince William County Virginia.

The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. By phone at 1-888-272-9829 jurisdiction code 1036. By mail to PO BOX 1600 Merrifield VA 22116.

Advance payments are held as a credit on your real estate personal property or business tax account and applied to a future tax bill when the tax rate and assessment are set or when you file your business tax return. Please contact us at. The real estate tax is paid in two annual installments as shown on the tax calendar.

Prince William County has one of the highest median property taxes in the United States and is ranked 120th of the 3143 counties in order of. How much is personal property tax in Prince William County. Prince William County accepts advance payments from individuals and businesses.

Find All The Record Information You Need Here. 300000 100 x 12075 362250. The Prince William County Police Department is requiring all businesses and residents to register their alarm systems with the department.

The Assessments Office mailed the 2022 assessment notices beginning March 14 2022. -- Select Tax Type -- Bank Franchise Business License Business. Interest at a rate of 10 per annum is added beginning the 1st day of the month following the original due date.

You may view the 2022 assessments via the online Real. Prince William County collects on average 09 of a propertys assessed fair market value as property tax. By creating an account you will have access to balance and account information notifications etc.

Market value is the probable amount that the property would sell for if exposed to the market for a reasonable period with informed buyers and sellers acting without undue pressure. Include one or more uppercase characters. When prompted enter Jurisdiction Code 1036 for Prince William County.

Press 1 for Personal Property Tax. Prince William County - Log in. The second and all subsequent installments are due on the 5th of each month with the final payment being due on June 5th.

However we can assist you in linking your real estate account. All real property in Prince William County except public service properties operating railroads interstate pipelines and public utilities is assessed annually by the Real Estate Assessments Office. Median Property Taxes Mortgage 3893.

The first monthly installment is due July 15th. Quarterly Project Report View status of current major County projects. Press 2 to pay Real Estate Tax.

The property tax calculation in Prince William County is generally based on market value. If payment is late a 10 late payment penalty is assessed on the unpaid original tax balance. If you have questions about this site please email the Real Estate Assessments Office.

Include one or more numbers. Ad Find Prince William County Online Property Tax Bill Info From 2021. Enter your payment card information.

Include one or more special characters. Unsure Of The Value Of Your Property. Prince William County real estate taxes for the first half of 2020 are due on July 15 2020.

Follow These Steps to Pay by Telephone. Payment by e-check is a free service. You can pay a bill without logging in using this screen.

If your real estate account does not show on the My Accounts screen it is because real estate account types generally do not automatically link when registering. Median Property Taxes No Mortgage 3767. Property Assessments Real Estate Information View and print real property assessment information.

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

National Park Service Prince William Forest Park Sign Virginia Travel National Park Service Forest Park

Prince William County Housing First Time Homebuyer Program Youtube

Pin On Prince William County Neighborhoods

Acting County Executive Proposes The Fiscal Year 2023 Budget Prince William Living

Prince William Co Residents Decry Proposed Hike In Tax Bills Wtop News

Class Specifications Sorted By Classtitle Ascending Prince William County

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

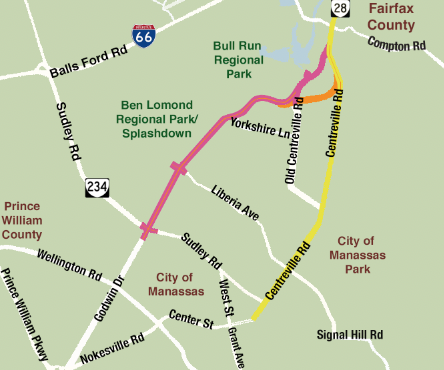

Prince William Area Leaders Call For Reconsideration Of Route 28 Bypass Headlines Insidenova Com

Prince William County Considers Rebranding Post Pandemic Headlines Insidenova Com

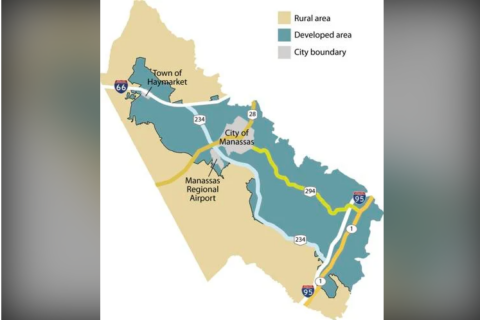

The Rural Area In Prince William County

Animal Advocates Call For A New Prince William Animal Shelter Headlines Insidenova Com

Prince William Wants To Hike Property Taxes Introduces Meals Tax

5572 Saint Charles Dr Woodbridge Va 22192 Dale City Saint Charles Keller Williams Realty

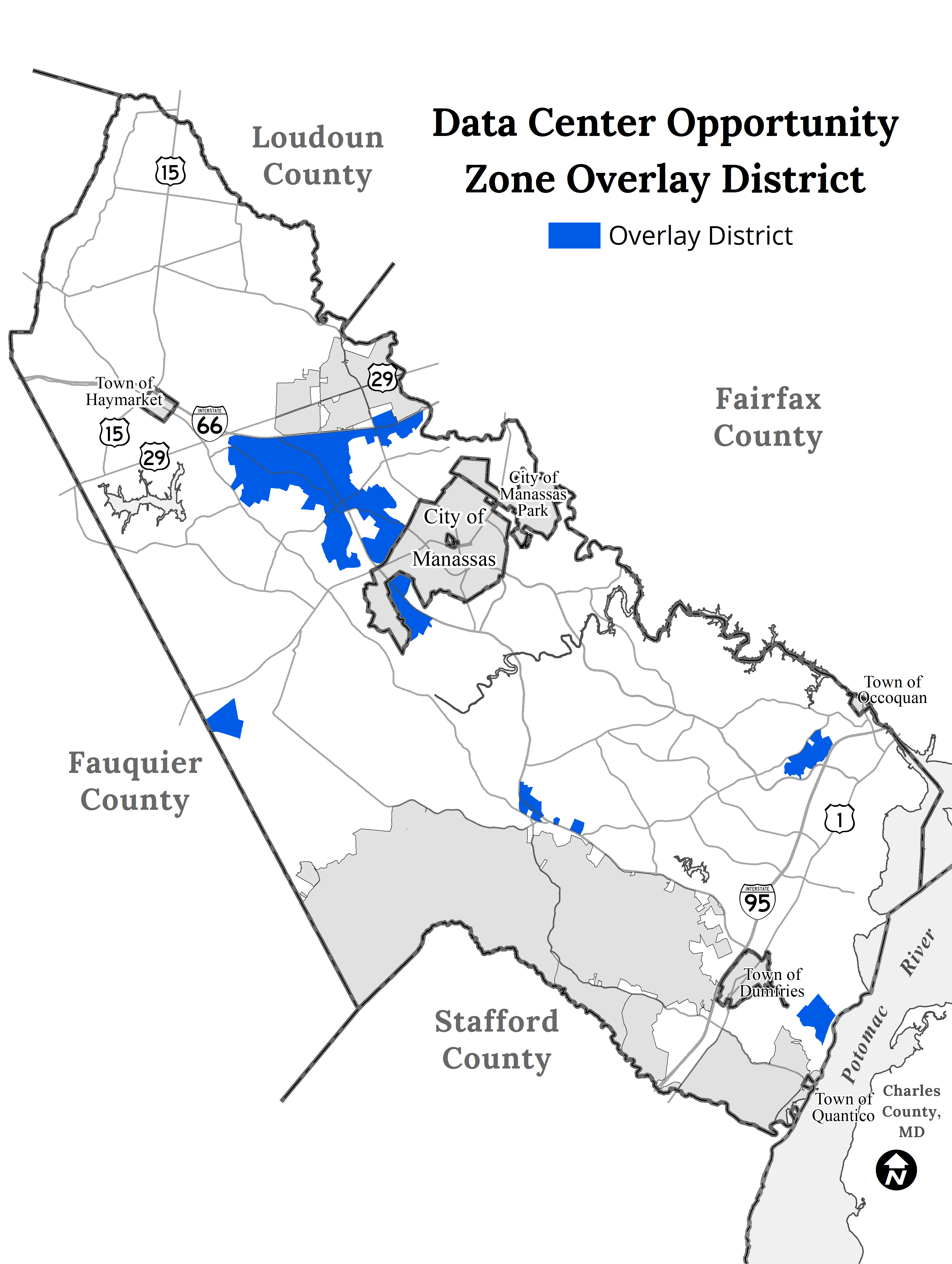

Data Center Opportunity Zone Overlay District Comprehensive Review

Prince William County Prince William County Prince William Dale City

Digital Realty Ups The Ante In Data Center Alley Data Center Knowledge News And Analysis For The Data Center Industry